Recently I wrote in relation to impending changes announced to Probate fees. These fees are as as described in the article “… so exorbitant there can be no other way to classify it other than the reintroduction of a death tax.” You can read the article here.

On 4th March 2016, The Law Society of South Australia passed a motion to the Members of the Legislative Council condemning these fees. The grounds for this are outlined below in the following memo:

The following is provided as background information for your consideration in relation to the Legislative Council’s vote as to the disallowance of the Supreme Court (Probate Fees) Variation Regulations 2016.

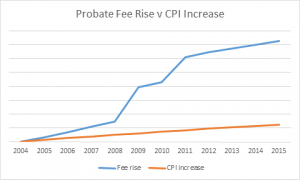

1. Probate filing fees have increased steadily (and at times, rapidly) each year by regulation.

2. In 2004, the fee was $565.

3. Over the next four years, the fee increases ranged from 3% to 4.14%.

4. In 2008, the fee was $651.

5. In 2009, it rose to $814, an increase of 25.04%.

6. In 2010, the increase was a modest 3.32%.

7. In 2011 it increased to $995, an increase of 18.31% over the previous year.

8. From 2012-2015, the fee increase each year has varied between 2.39% to 3.32%.

9. The graph below shows the annual probate fee increase since 2004 compared with the CPI increase over the same period.

10. Probate filing fees historically have applied to all estates, regardless of the size of the estate.

11. The Law Society does not object to annual review of fees.

12. The Law Society sees the advantage in lower fees for minor estates. However, fees valued at less than $200,000 represent a minor number of applications for probate.

13. The current increase in fees, however, represents an increase of between just under 35% and nearly 170% for the vast majority of applications for probate.

14. The fees are also now based on a gross rather than net valuation of the estate. That is unjust because it is a false valuation of the estate.

15. If a house has a gross value of $800,000 but is 80 per cent mortgaged, the real value of the estate to beneficiaries under the Will is $160,000. But they will now be charged a fee that ignores the mortgage.

16. In addition, the tiered system accompanying the gross estate valuation under the new regulations will result in even longer delays than are currently experienced in obtaining probate.

17. The new tiered system of fees will require staff of the Probate Registry to check each sub-addition and addition in each statement of assets and liabilities. This undoes previous efforts by the Probate Registry to avoid checking such statements and to shorten delays.

18. Historically, fee increases for grants of probate have not been used to upgrade the facilities at the Probate Registry – which remain very much dated and inefficient – nor have increased fees been put towards employment of additional probate staff to assist with processing and the reduction of delay.

19. Filing fees in SA are already well above the national average.

20. In WA, a flat fee of $304 applies.

21. In Victoria, the fee is $306.

22. In Queensland, the fee is $637.40.

23. In Tasmania, the fee is $400 for grants of an estate worth less $250k; over $250k the fee is $750.

24. NSW has a tiered system, much the same as that proposed in SA, but the SA fees are even greater than those of NSW.

25. In SA, the fee for an estate valued between $200-$500K is $1,500 whereas in NSW the fee for the same tier is $953. For estates valued between $500K-$1M, the new fee in SA is $2,000; in NSW, the fee is $1,460. For estates valued at more than $1M, the fee in SA is $3,000; in NSW, the fee is $3,243. NSW has yet another tier for estates worth more than $5M.

26. The Society commends the disallowance Motion to the House and submits the Motion is in the interests of removing a burdensome and unfair method for the charging of probate application fees.